UK Trade May 2025 5 Critical Insights Logistics Companies Need

The latest UK trade data for May 2025 reveals significant patterns that demand strategic attention from logistics providers and freight forwarding companies. With goods exports increasing by £0.6 billion whilst the overall trade deficit widens dramatically, understanding these trends is crucial for operational planning and competitive positioning.

The Office for National Statistics May 2025 trade bulletin provides essential insights into evolving market dynamics that will shape logistics strategies throughout the remainder of 2025. For companies like SARR Logistics, these developments highlight both opportunities and challenges requiring immediate strategic consideration.

Goods Export Growth Signals Market Recovery

UK goods exports demonstrated resilience in May 2025, increasing by £0.6 billion to reach £29.1 billion.

UK goods exports demonstrated resilience in May 2025, increasing by £0.6 billion to reach £29.1 billion.

This 2.2% monthly growth represents encouraging momentum following the significant disruptions experienced in previous months, particularly the US tariff related volatility that impacted April trade volumes.

The export growth was driven by increases to both EU and non EU destinations, with EU exports rising by £0.4 billion and non EU exports increasing by £0.2 billion. This balanced growth pattern suggests improving market conditions across multiple trading relationships rather than dependence on single corridor recovery.

For freight forwarding companies, this export growth indicates renewed demand for international shipping services and suggests clients are adapting to new trade conditions whilst maintaining global market engagement. Companies with diverse route portfolios and flexible capacity management will be best positioned to capitalise on this recovery trend.

Total Imports & Exports of goods increased in May

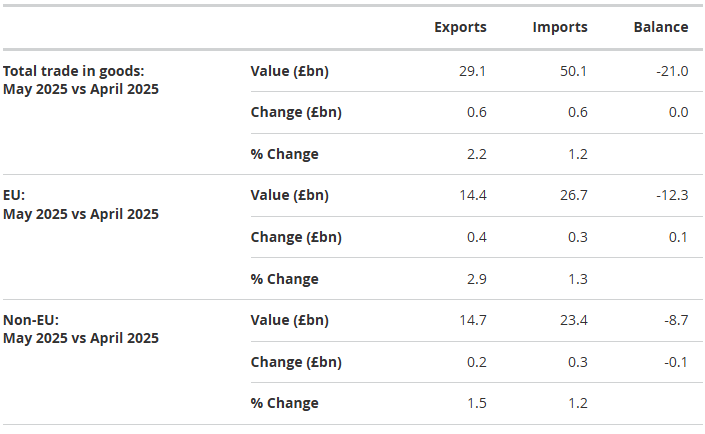

The table below shows monthly UK trade in goods, excluding precious metals, current prices, seasonally adjusted, EU and non-EU sourced by the UK trade statistics from the office for national statistics.

Import Surge Creates Capacity Challenges

Whilst export growth provides positive signals, the simultaneous increase in goods imports by £0.6 billion to £50.1 billion creates complex operational challenges for logistics providers. Import growth of 1.2% indicates sustained domestic demand but also contributes to widening trade deficits that may influence future policy decisions.

The import increase was distributed across EU sources (£0.3 billion rise) and non EU countries (£0.3 billion rise), demonstrating continued reliance on international supply chains despite ongoing trade tensions and regulatory changes affecting global commerce.

This import growth pattern requires logistics companies to maintain adequate inbound capacity whilst managing export demand recovery. Companies offering comprehensive import services, including customs clearance and documentation support, face increased demand for these specialised services.

US Trade Relations Show Cautious Recovery

Perhaps most significantly for international logistics planning, UK exports to the United States rose by £0.3 billion in May 2025, following the substantial decrease experienced in April. This recovery, whilst modest, suggests businesses are adapting to new tariff structures and finding viable pathways for continued transatlantic trade.

Perhaps most significantly for international logistics planning, UK exports to the United States rose by £0.3 billion in May 2025, following the substantial decrease experienced in April. This recovery, whilst modest, suggests businesses are adapting to new tariff structures and finding viable pathways for continued transatlantic trade.

The increase was primarily driven by chemical exports, particularly inorganic chemicals, indicating that certain sectors are successfully navigating the challenging tariff environment. However, the ONS notes that export values remain relatively low, emphasising the continued impact of trade barriers on overall volume levels.

Simultaneously, imports from the United States decreased by £0.9 billion, reflecting reduced British demand for American goods across multiple categories including fuels, machinery, and transport equipment. This pattern creates opportunities for logistics companies offering alternative sourcing solutions and route optimisation services.

Chemical Sector Leads Export Recovery

The chemical sector’s performance in May 2025 provides encouraging signals for high value UK exports. Increased chemical exports to non EU countries, particularly the United States, demonstrate the sector’s resilience and adaptability in challenging trade environments.

Chemical exports represent one of the UK’s key competitive advantages in international markets, encompassing pharmaceuticals, specialty chemicals, and industrial compounds that command premium pricing and offer substantial value addition. The sector’s recovery suggests that businesses are finding pathways through regulatory complexity and trade barriers.

For logistics providers, chemical shipments often require specialised handling capabilities, including dangerous goods declarations and temperature controlled transportation. Companies with expertise in chemical logistics are positioned to benefit from this sector’s recovery and continued growth potential.

Trade Deficit Expansion Signals Economic Pressure

The widening trade deficit represents a significant concern for UK economic policy and logistics planning. The three month trade deficit expanded by £6.7 billion to £13.2 billion, driven primarily by increased goods imports and reduced goods exports over the measurement period.

This deficit expansion reflects multiple factors including domestic demand strength, international supply chain dependencies, and the ongoing impact of trade disruptions on export competitiveness. The scale of deficit growth suggests that trade rebalancing remains a priority challenge for UK economic policy.

For logistics companies, deficit trends influence long term capacity planning and investment decisions. Understanding these patterns helps inform route development, facility investment, and service portfolio expansion strategies that align with evolving trade flows and policy priorities.

EU Trade Relationships Maintain Stability

Despite ongoing regulatory complexity following Brexit implementation, UK EU trade relationships demonstrated relative stability in May 2025. EU export growth of 2.9% and import growth of 1.3% suggest that businesses have largely adapted to post Brexit trading arrangements and established effective operational procedures.

Despite ongoing regulatory complexity following Brexit implementation, UK EU trade relationships demonstrated relative stability in May 2025. EU export growth of 2.9% and import growth of 1.3% suggest that businesses have largely adapted to post Brexit trading arrangements and established effective operational procedures.

The continued importance of EU trade relationships emphasises the value of logistics expertise in European corridors and regulatory compliance. Companies maintaining strong EU networks and compliance capabilities continue to serve essential market needs despite ongoing complexity.

SARR Logistics’ experience with European logistics operations and comprehensive understanding of regulatory requirements positions the company to support clients requiring reliable EU trade services. The stability of these relationships provides a foundation for continued business development and operational expansion.

Services Trade Perform Provides Economic Balance

Whilst goods trade deficits expanded, the UK’s services trade performance continues to provide economic balance and demonstrates competitive advantages in high value service exports. Services exports increased by an estimated £1.7 billion over the three month period, reflecting continued international demand for UK expertise.

The services surplus helps offset goods trade deficits and highlights the UK’s competitive positioning in knowledge based industries, financial services, and professional consulting. This pattern suggests opportunities for logistics companies supporting service sector exports through business travel facilitation and document handling services.

Regional Trade Pattern Analysis

The geographic distribution of trade growth reveals important strategic implications for logistics planning. EU trade maintained steady growth patterns whilst non EU trade showed more volatile characteristics, reflecting the continuing impact of changing trade relationships and policy developments.

Understanding regional trade patterns helps logistics companies optimise their route networks, capacity allocation, and service portfolios. Companies with expertise across multiple geographic corridors can provide clients with flexible solutions that adapt to changing trade patterns and regulatory environments.

SARR Logistics’ expertise in air freight forwarding and comprehensive route portfolio enables the company to support clients across diverse trade relationships whilst maintaining service quality and competitive pricing.

Future Planning Implications for Logistics Providers

The May 2025 trade data suggests several strategic implications for logistics planning and business development. Export recovery trends indicate growing demand for international shipping services, whilst import growth creates opportunities for comprehensive inbound logistics support.

The continued volatility in US trade relationships emphasises the importance of flexible routing options and alternative market development. Companies with diversified service portfolios and strong regulatory expertise will be best positioned to navigate continuing uncertainty whilst capturing growth opportunities.

For companies requiring comprehensive logistics support through complex trade environments, SARR Logistics offers expertise in supply chain mapping, regulatory compliance, and operational optimisation that helps clients maintain competitive advantage whilst managing risk and uncertainty.

For expert guidance on navigating evolving UK trade conditions, SARR Logistics provides comprehensive logistics solutions designed to support businesses through challenging market environments. Our expertise in international trade management, regulatory compliance, and supply chain optimisation helps companies maintain operational excellence whilst adapting to changing conditions.

Contact our experienced team at [email protected] or call 0333 224 1 224 to discuss how we can support your logistics operations through current market conditions. From customs clearance to strategic route planning, SARR Logistics delivers the expertise and attention to detail your business requires.![]()

Conclusion

The May 2025 UK trade data reveals a complex picture of recovery and continued challenge across different sectors and trading relationships. Whilst goods export growth provides encouraging signals, widening trade deficits and continued US trade volatility emphasise the importance of strategic logistics planning and operational flexibility.

Success in this environment requires comprehensive understanding of regulatory requirements, flexible routing capabilities, and expertise across multiple service areas. Companies that invest in operational agility and maintain strong compliance capabilities will be best positioned to support clients through continued uncertainty whilst capturing emerging opportunities.

The data suggests that UK trade relationships continue evolving in response to policy changes and global economic conditions. Logistics providers that maintain strategic focus on client service whilst adapting to changing market conditions will deliver sustained value and competitive advantage.

FAQ

What do the May 2025 trade figures mean for UK exporters?

The May 2025 data shows encouraging signs with goods exports increasing by £0.6 billion, representing 2.2% monthly growth. This suggests UK exporters are adapting to challenging conditions and finding viable pathways for international market access, particularly through EU relationships and selective US market recovery.

How are US trade relations affecting logistics operations?

UK exports to the United States showed modest recovery in May 2025, rising by £0.3 billion following April’s significant decline. However, values remain relatively low, indicating continued impact from tariff barriers. Logistics companies need flexible routing options and comprehensive advisory services to support clients navigating US trade complexity.

What sectors are driving UK export growth?

Chemical exports, particularly inorganic chemicals to the United States, led export recovery in May 2025. This sector’s resilience demonstrates the importance of high value, specialised exports that can absorb increased trading costs whilst maintaining competitiveness in international markets.

How significant is the widening trade deficit?

The three month trade deficit expanded by £6.7 billion to £13.2 billion, representing substantial economic pressure. This expansion was driven primarily by increased imports and reflects ongoing challenges in export competitiveness and domestic demand patterns that influence long term economic policy.

What should logistics companies focus on given these trends?

Companies should prioritise operational flexibility, regulatory expertise, and diversified service portfolios. The data suggests continued volatility across different trading relationships, making adaptability and comprehensive compliance capabilities essential for supporting clients through challenging market conditions.