HTS Code Cost Analysis: Savings & Ensuring Compliance

Introduction

In today’s increasingly complex global marketplace, businesses involved in international trade must navigate a myriad of regulations and cost structures. One essential tool for achieving this is HTS (Harmonized Tariff Schedule) Code cost analysis. This blog post delves deep into how mastering HTS Code cost analysis not only uncovers hidden savings but also ensures compliance, minimising risks and penalties.

Understanding HTS Codes

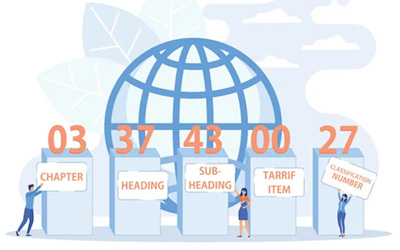

HTS Codes are standardised numerical codes used to classify traded products. They play a pivotal role in determining tariff rates, facilitating customs clearance, and ensuring that shipments meet regulatory standards. Accurate classification is critical because even minor errors can lead to unexpected costs or compliance issues.

HTS Codes are standardised numerical codes used to classify traded products. They play a pivotal role in determining tariff rates, facilitating customs clearance, and ensuring that shipments meet regulatory standards. Accurate classification is critical because even minor errors can lead to unexpected costs or compliance issues.

- Classification and Tariff Determination:

Every product is assigned a specific HTS code that dictates its applicable tariffs. The correct classification can influence duty rates, import/export restrictions, and even eligibility for trade agreements. - Regulatory Compliance:

Adhering to HTS guidelines is a must. Proper classification not only avoids penalties and fines but also maintains your company’s reputation as a compliant and responsible trader.

The Importance of HTS Code Cost Analysis

A detailed HTS Code cost analysis is vital for several reasons:

- Cost Optimisation:

By analysing and understanding the classification and associated tariff rates, businesses can identify opportunities to reduce duty costs. This means reassessing product classification, exploring tariff engineering, or even leveraging trade agreements. - Risk Management:

Misclassification can result in hefty fines, shipment delays, and increased scrutiny from customs authorities. An accurate HTS analysis acts as a pre-emptive measure to manage these risks effectively. - Strategic Planning:

Knowing where cost inefficiencies lie enables companies to adjust their sourcing, manufacturing, or shipping strategies. It fosters proactive decision-making that leads to long-term savings.

Unlocking Savings Through Effective Cost Analysis

Implementing a robust HTS Code cost analysis strategy involves a multi-step approach:

1. Comprehensive Data Collection

Gather all relevant data including product descriptions, manufacturing details, and historical tariff records. An accurate dataset forms the foundation of reliable analysis.

2. Detailed Classification Review

Review the current classification of your products. Sometimes, products may have been misclassified, leading to unnecessary duty costs. Regular audits can help uncover these errors and ensure that your HTS codes are aligned with the latest regulatory standards.

3. Leveraging Technology and Expertise

Invest in advanced software solutions and partner with experts in international trade compliance. These tools and partnerships can help automate the classification process, flag anomalies, and provide actionable insights.

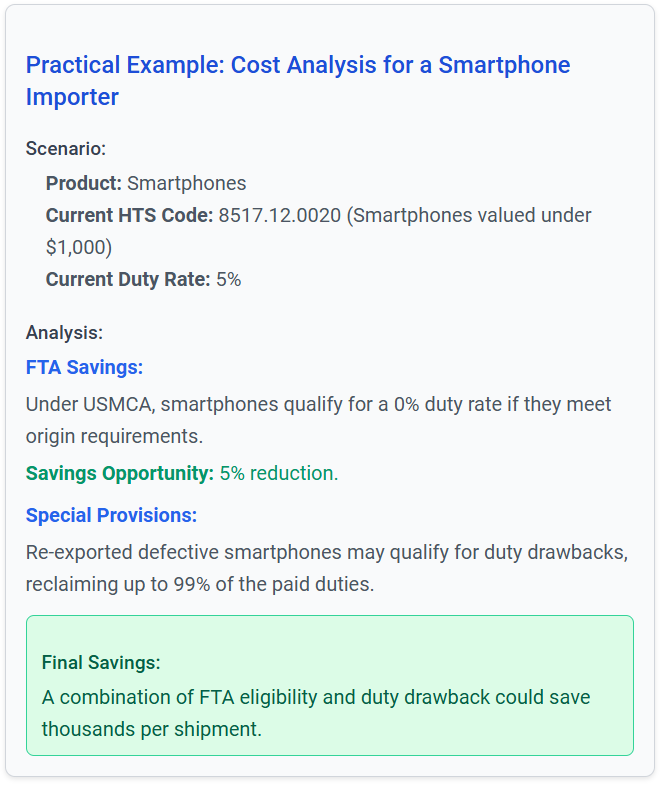

4. Analysing Trade Agreements & Duty Drawbacks

Many countries offer preferential tariffs or duty drawback programs under specific trade agreements. A thorough cost analysis can reveal if your shipments qualify, potentially reducing overall duty expenses.

5. Continuous Monitoring and Adjustment

Global trade regulations are in a state of continuous change (a constant flux). Regularly updating your HTS classifications and tariff analyses ensures that your business remains compliant and cost-effective even as policies evolve.

Ensuring Compliance with Best Practices

Compliance is not just about avoiding fines—it’s a strategic advantage that builds trust with partners, customers, and regulators. Here are some best practices to ensure you’re on the right track:

Compliance is not just about avoiding fines—it’s a strategic advantage that builds trust with partners, customers, and regulators. Here are some best practices to ensure you’re on the right track:

- Stay Updated on Regulatory Changes:

International trade laws and HTS codes can change. Subscribe to updates from customs authorities and international trade bodies to ensure your information is current. Codes can be found at Gov.UK Trade Tariff for UK and Harmonized Tariffs Schedule. for US - Implement Regular Audits:

Routine internal and external audits help detect misclassifications early. Use these audits as an opportunity to refine your processes and correct any discrepancies. - Train Your Team:

Ensure that employees involved in product classification and customs documentation are well-trained and updated on best practices and regulatory changes. - Document Everything:

Maintain thorough documentation for every product classification decision. This is invaluable if your business ever faces an audit or dispute with customs authorities.

Real World Savings & Compliance Success

Consider a multinational electronics manufacturer that undertook a comprehensive review of its HTS code classifications. By partnering with trade compliance experts and leveraging sophisticated analytics software, the company discovered that several product categories were misclassified, resulting in over 20% excess in duty payments. Correcting these classifications not only unlocked substantial savings but also enhanced the company’s credibility during regulatory reviews.

Consider a multinational electronics manufacturer that undertook a comprehensive review of its HTS code classifications. By partnering with trade compliance experts and leveraging sophisticated analytics software, the company discovered that several product categories were misclassified, resulting in over 20% excess in duty payments. Correcting these classifications not only unlocked substantial savings but also enhanced the company’s credibility during regulatory reviews.

Similarly, a major importer in the fashion industry used HTS code cost analysis to optimise its supply chain. Through detailed analysis, the company identified qualifying products for duty drawback programs, saving millions annually while ensuring full compliance with trade regulations.

Conclusion

Mastering HTS Code cost analysis is a game changer for businesses engaged in international trade.

By understanding the intricacies of product classification and tariff determination, companies can unlock hidden savings and ensure strict compliance with global regulations.

The investment in accurate analysis, advanced technology, and continuous education not only minimises financial risks but also establishes your business as a trusted player in the market.

Embrace the power of HTS Code cost analysis today—optimise your cost structure, enhance regulatory compliance, and set your business on the path to sustained international success.

By integrating these expert strategies and best practices into your operations, you can achieve unparalleled efficiency and compliance in your global trade endeavours. Start mastering your HTS Code cost analysis now and experience the transformative impact on your bottom line.

FAQ

What are HTS codes in the UK?

What are HTS codes in the UK?

An HTS code is an international harmonised system of numbers and names used to classify traded products. They support global trade by simplifying customs processes, helping countries to accurately impose tariffs, collect trade statistics, and enforce trade regulations.

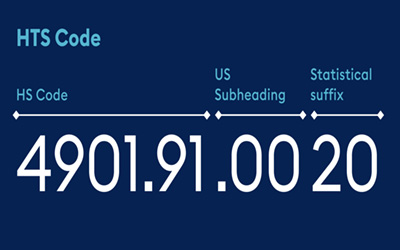

What is the difference between HS code and HTS code?

The main difference between an HS code and an HTS code is the number of digits and the country of destination.

HS code: A six-digit code used internationally to classify products. HS stands for Harmonised System.

HTS code: A ten-digit code used in the United States to classify products for customs and tariff purposes.

HTS stands for Harmonised Tariff Schedule.

Are HTS codes Universal?

HS codes are universal while HTS codes are country-specific. They are both used to classify imported goods on a global scale.

SARR Logistics UK

With a legacy built on trust, backed by extensive experience, a global network, and a customer centric approach, SARR Logistics UK emerges as the ultimate partner for all your supply chain mapping needs. We are in touch with the latest cloud based systems to keep us well informed of all the latest HS and HTS codes.

If you would like to know more reach out to us today and experience a seamless, efficient, and dependable shipping solution tailored to elevate your business. For further inquiries and to explore how SARR Logistics UK can help you save money contact our team. We are always happy to help.![]()

What are HTS codes in the UK?

What are HTS codes in the UK?